Note: for ease of understanding, all costs, prices, rents, and so on are presented in 2014 dollars, adjusted from 1964 dollars per the BLS inflation calculator.

Discussions on affordable housing in Los Angeles, and California in general, often include debate on how to maintain existing affordable housing stock. These buildings, constructed mainly in the 1950s and 1960s, are referred to as dingbats. They are invariably low-rise wood-frame and stucco construction, though there’s some variability in scale, from the classic single-lot six-unit dingbat to larger buildings constructed on several assembled single-family lots.

While there’s a lot of interest in preserving the affordable housing units in these buildings, there’s a curious lack of interest in how dingbats came to exist. Despite the fact that many were speculative, they were purpose-built affordable housing, and they were built in mass for decades. It stands to reason that a city facing a huge shortage of affordable housing should want to understand how the dingbats were built, and if we might build large amounts of affordable housing by the same process today.

Fortunately, the dingbats are not a mystery. In The Low-Rise Speculative Apartment, published in 1964, Wallace Francis Smith offers a detailed analysis of the dingbat construction boom then taking place in Oakland. Presciently, Smith concluded that dingbats were serving a useful function in society, and that their construction ought to be encouraged. As we will see, the opposite happened, but to start, let’s consider the factors that, per Smith, enabled construction of dingbats:

- Savings looking for investment, and thus lending institutions with excess lending capacity.

- Investors looking to buy small residential properties upon completion.

- Depreciation tax incentives that made the properties attractive investments for high-income individuals, even if the nominal net cash flow from operations was very small.

- Low cost of land per dwelling unit (du), median $10,700.

- Low cost of construction per du, median $47,185.

- Short duration of construction, median 7-9 months but as little as 3 months.

- Zoning that allowed single-family residences (SFRs) to be replaced by dingbat apartment construction.

Parking requirements, as enacted by Oakland in 1961, were determined to increase construction costs, but not to the extent that they stopped construction altogether. Rather, marginal projects (which logically include the most affordable dwelling units) became impossible to build profitably.

These conditions produced a large quantity of affordable units. One bedroom units, averaging 635 SF, rented for an average of $820/month. Two bedroom units, averaging 835 SF, rented for an average $1,055/month. You can scarcely rent something in the oldest buildings in the cheapest neighborhoods in LA today, let alone new construction.

Dingbat Factors Today

Ok, all of that is great for people in 1964. What about 2014? Could the same combination of factors allow for a boom in affordable housing construction in Los Angeles today?

The first three factors relate to availability of financing and willing investors. This is not the area of expertise for this blog, but lending capacity does not seem to be an issue. Neither does the ability to find investors; consider the current level of foreign interest in owning real estate in US cities. Tax structures relating to depreciation are not something that can be addressed at the city level, and would require federal action.

The next three factors concern the costs of planning, permitting, and building the project. Cost of land per dwelling unit was very low for the dingbats. Assuming R4 zoning, which allows 12 du on a 5,000 SF lot, you’d have to be able to buy such a lot for $125,000 to get similar land costs per unit. You simply cannot find buildable lots that cheaply in LA today.

Construction costs were also very low, with the figures above equating to about $75/SF for building a dingbat. This is not out of line for construction of SFRs today; you can buy new SFR construction for as little as $85/SF in places like Adelanto. Perhaps it’s possible to see classic dingbats as big SFRs. On the other hand, dingbat construction is universally considered to be low quality, good enough only to meet the building codes of the time, lacking in amenities like, say, soundproofing between apartments. In addition, changes in seismic building codes in response to the 1970 Sylmar earthquake and the 1994 Northridge earthquake have undoubtedly increased construction costs for structures with open stories on the ground floor, like the classic dingbat carport. Today’s multifamily construction costs are much higher, often over $200/SF.

Duration of construction indirectly impacts construction costs, because carrying costs are increased when the duration of construction is longer. Much construction, including many of the original dingbats, is financed by a construction loan, which is paid off and replaced by a permanent loan when the building is complete (or when the speculative builder sells the completed building to an investor). Construction loans usually have higher interest rates than permanent loans. The faster construction can be completed, the faster the building can be put into revenue use and the construction loan retired. The city can reduce duration of construction by facilitating permitting and working to schedule building inspections so that they minimize downtime on the jobsite.

Lastly, there’s the need for zoning that allows dingbat construction. In LA, this generally means R3 or R4, which allow 6 du and 12 du on a typical 5,000 SF (50’ by 100’) lot, with R3 corresponding to the classic image of a dingbat. R5 zoning allows 25 du on such a lot, but this can’t practically be accomplished with wood-frame construction given setback, height, and floor-to-area (FAR) zoning requirements. Since 1970, zoning changes have significantly reduced the amount of R3 and R4 zoned land, especially in areas like the Westside. While small apartment buildings are still built in neighborhoods like Palms, in most places, they are precluded by zoning.

Parking requirements are part of zoning; in LA, zoning stipulates 1 spot per studio, 1.5 spots per 1 bedroom apartment, and 2 spots per 2+ bedroom apartment. As we shall see shortly, they have a major impact on the cost and feasibility of small apartment building construction, particularly on small lots.

Let a Thousand Dingbats Bloom

Given these parameters, let’s try to make dingbat construction work today, and see what cost inputs we might be able to change.

Dingbat, 1964

Now, what do good engineers do before performing tests? They calibrate their equipment! So first, here’s a shot at analysis of dingbat construction in 1964.

The columns on the left present a breakdown of total costs and costs per unit. “Soft costs” refers to things like design and permitting; other cost categories are hopefully self-explanatory. At center, you can see we are assuming a classic 6-unit dingbat, the typical 635 SF 1-BR apartment size, and construction costs of $75/SF. “Efficiency” refers to the ratio of usable apartment space to total building size, which includes unproductive areas like stairwells. At right are assumptions for several cost categories: soft costs are assumed to be 10% of construction, marketing 1% of construction, carrying costs 8% of land plus demolition plus construction, and profit 6% of land plus demolition plus construction.

To convert this to a monthly rent, we first calculate a monthly mortgage payment by taking the cost per unit and amortizing it out over 30 years, at an assumed loan rate of 6%. Since rents must also cover building operating costs and unit vacancies between tenants, we divide the mortgage payment by 70% and then 95%, thereby accounting for 5% vacancy and operating costs equal to 30% of gross rents. Operating costs of 30% are a little on the lean side for LA apartment buildings, but not unreasonable.

And, voila! We get a monthly rent in the vicinity of the rents reported by Smith in 1964. Note two things here. First, a rough guess of monthly rent is about 0.90% of total costs. This is a little higher than some other estimates I found (0.75% to 0.80%), but let’s err on the side of caution. (If you assume an equity investment of 20%, you could cover the mortgage and operating costs with monthly rent of 0.73%.) Second, we can assess the contribution of each cost category to monthly rent. As you’d expect, construction costs dominate, followed by land costs.

Palms West, 2014

Back to the present. What would a small development look like on the Westside? Fire up ZIMAS and look to the north and west of Palms, and you’ll see large areas in yellow, which indicates R1 single-family zoning.

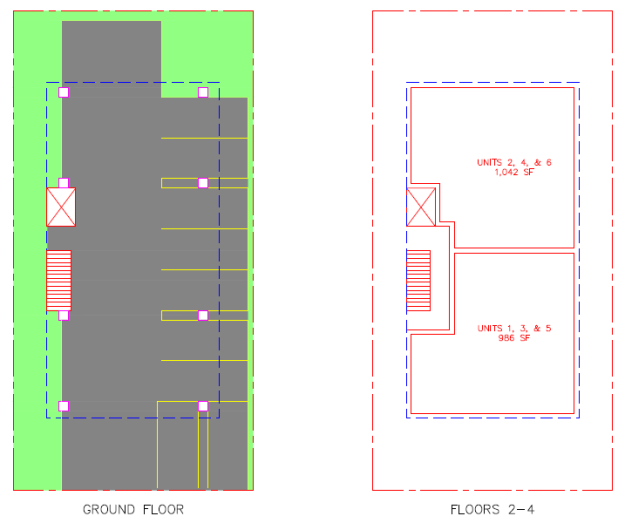

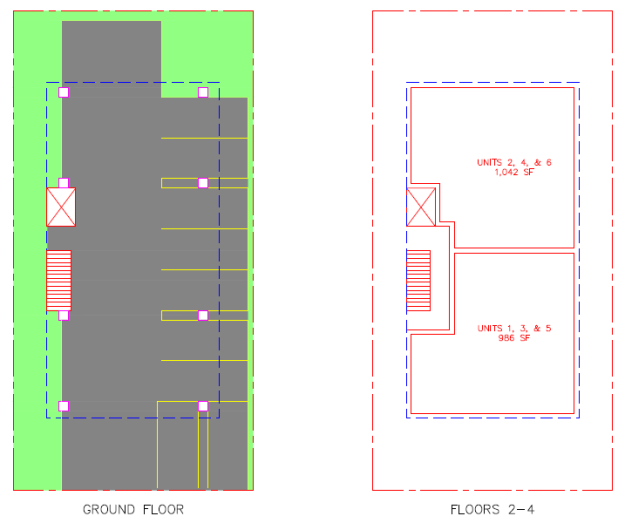

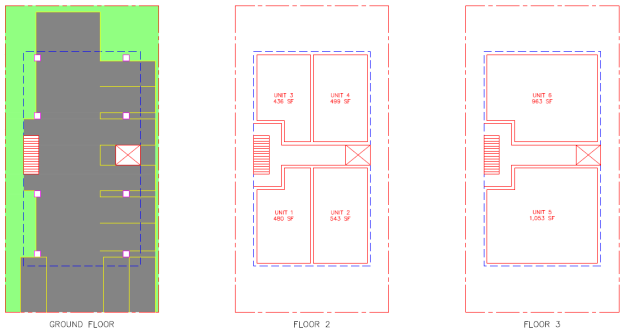

Looking at some of the less expensive areas, you can find an SFR in for something like $800,000. Let’s assume it’s upzoned to R3, which would allow six units. I know a lot of readers don’t like bundled parking, but for the sake of argument, assume it’s hard to sell condos in these neighborhoods without parking. Since they’re primarily single-family, there’s not a lot in walking distance and it might be a hike to decent transit. Yes, condos. Not your parents’ dingbats, but when you’re paying that much for land, it’s probably the way to go. Here’s one possible configuration, meeting city parking and setback requirements.

Four stories, parking on the ground level, and two units per floor above that. I assumed elevators would be required for all buildings. This gives you as simple a design as possible for the podium, which would probably have to be concrete. Costs are presented below.

Soft costs were increased to 15%, to account for increased permitting and design costs, and marketing to 8%. Construction costs were assumed to be $225/SF, a rough estimate based on a variety of sources for podium type construction. Could you sell these generously sized 1-BR condos for about $525,000 on the Westside today? I think so.

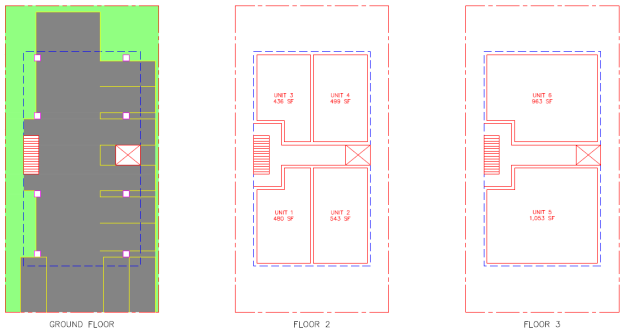

Here’s another option for Westside development, with a three-story building that has four small units and two large units. I bumped construction costs up to $250/SF to account for the higher proportion of concrete.

For this option, I split all costs except construction equally among the units. This gives some units just under $400,000. Distributing costs differently would decrease the price for the small units, but increase it for the large ones.

Vermont Knolls, 2014

Fine, you say, but wasn’t the point of this post to look at affordable housing? Let’s take this model to Vermont Knolls, a part of South LA bounded by the 110, Normandie, Manchester, and Florence. Some areas are zoned R3, but most are zoned for less density (RD, R2, or R1). Here, the cost of a single-family lot is something like $300,000.

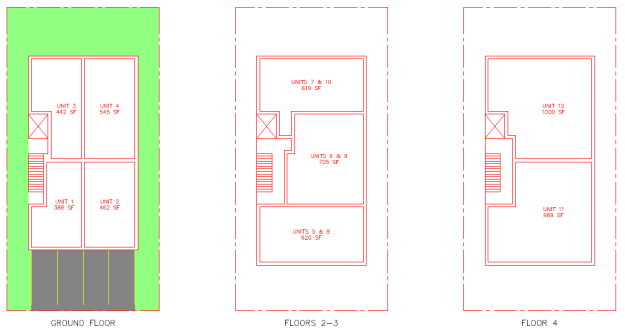

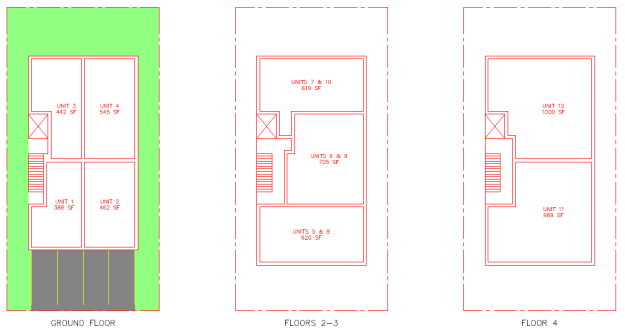

To drive down the cost of land per unit, let’s assume it’s upzoned to R4, which again allows 12 du on a normal lot. Here, we can really see the impact of parking requirements. Even if all 12 units are nominally studios, the zoning requires 12 parking spaces, which would be nearly impossible to configure on a 5,000 SF lot with only 50’ of street frontage. Let’s assume the city eliminates parking requirements; we’ll still throw in a few parking spaces out front – they’re nearly free and would generate some additional revenue.

Three stories, four apartments each floor. Construction costs were assumed to be $140/SF, on the low end of what I’ve seen for low-rise construction in LA. Soft costs were dropped back to 10%, on the assumptions that design costs would be reduced by working from a cookie cutter plan and that the city would facilitate permitting and inspection. Marketing was dropped to 1%; affordable apartments rent themselves.

Hitting rents under $1,300/month is a big deal. Why? Well, if we raise the minimum wage to $13/hr, a full-time minimum wage worker would make about $26,000/year. A two-worker household would earn about $52,000/year. Using the 30% of income standard, a brand new $1,300/month apartment is affordable for such a household. If construction costs could be driven down more, all the better; for example, at $100/SF, the rent would be about $1,000/month.

Here’s another option, going with four stories and a mix of studio/1BR (ground floor), 2BR (floors 2-3), and small 3BR apartments (floor 4). Costs were apportioned the same way as the Westside plan.

I’m not sure if these larger size apartments would be competitive with existing rental stock. Again, driving construction costs down would make a big difference; at $100/SF, the 1BRs would be about $1,000/month, the 2BRs around $1,200/month, and the 3BRs $1,550/month.

ADU Sidebar

What’s even more affordable than dingbats? Accessory dwelling units. These can be very basic one-story wood-frame projects. If the property owner does the development, there’s no land or demolition cost, and we can safely assume true SFR construction costs, say $80/SF. For a 700 SF ADU, we get the following costs.

Importance of Single Lot Projects

Readers have probably noticed that all the development concepts in this post are based on single lot projects. Lot assembly greatly facilitates things; for example, by putting two lots together, you eliminate the lost space of the side setbacks between them, which lets you offer larger apartments. This will also drive down costs per square foot, because larger apartments usually include more cheaply built living space, rather than more expensive kitchen and bathroom space.

However, I think the ability to profitably develop a single lot is crucial, because it eliminates the potential for adjacent owners to hold out for huge payouts. Indeed, as Smith notes, most of the original dingbats were built without even considering lot assembly, which was deemed to add too much time to the process. If a single lot can be developed profitably, it’s mutually beneficial if adjoining owners decide to consolidate and develop a larger building. This also eliminates the need for city planning agencies to go down into the weeds and use eminent domain to assemble lots large enough to be feasible. The city could facilitate single lot projects by reducing or eliminating parking requirements and reducing setbacks.

Be Proactive, Not Reactive

An approach to affordable housing that strives to enable market-rate construction of projects like these all over the city is a more proactive policy. Trying to save existing affordable units, while necessary in the short run due to California’s terrible housing situation, can only slow down, but never reverse, the worsening affordability problem. Note that projects like the Westside condo examples presented are critical to this approach to housing, because they alleviate market demand for upscale neighborhoods. If development is strangled on the Westside, gentrification elsewhere is almost inevitable.

This approach isn’t available to every city. LA is large city, and have a variety of neighborhoods, including some where land costs are not prohibitively high. This may not be true for a place like San Francisco, where it seems improbable that $1,500/month 2BRs could be built in the city under current conditions. Because counties and municipalities are smaller in the Bay Area, there will likely need to be more cooperation between jurisdictions.

In LA, though, we should be able to permit and encourage construction of a variety of housing. We ought to do so while we have the chance.

This post owes a debt of gratitude to this post on costs in SF by Mark Hogan, and helpful interaction from @markasaurus, @eparillon, and @mottsmith on Twitter.

*Smith gives $44,315 as the permit construction cost. In Appendix A, this is estimated to represent 82% of total development costs, which included lending and marketing costs. Actual construction costs were estimated as 87.31% of total development costs. Therefore, I assumed actual construction cost per unit was 0.8731 * ($44,315 / 0.82) = $47,185.